Donald Trump’s tax returns will mean nothing and will change nothing. My prediction is that the democrats would be better off not going after them, and just painting a big picture of what a gigantic cheater Trump must be – keep it vague and unspecific.

So, that’s my prediction. It’s going to be another “big nothing.”

Most of the democrats (like Pelosi) who are rich, are the ones who aren’t making a great big deal out of what’s in Trump’s returns because they know what we’ll find. If it triggers any public reaction, it’ll be a reaction to get mad at rich people (in general) rather than Trump (in particular) – in fact Trump, the spin-master, will probably cast his non-payment of taxes as a virtue – and his base will fall for that, too.

Back in the 90s when I was making a lot of money, I got into dealing with the problems that come with making a lot of money, i.e.: taxes. The US tax code is designed so that there are huge cut-outs that rich people can drive a truck through. Everyone who’s got more than a couple million dollars learns this stuff, so I assume everyone in congress except maybe Alexandria Occasio-Cortez and Ilhan Omar already know how US taxes work.

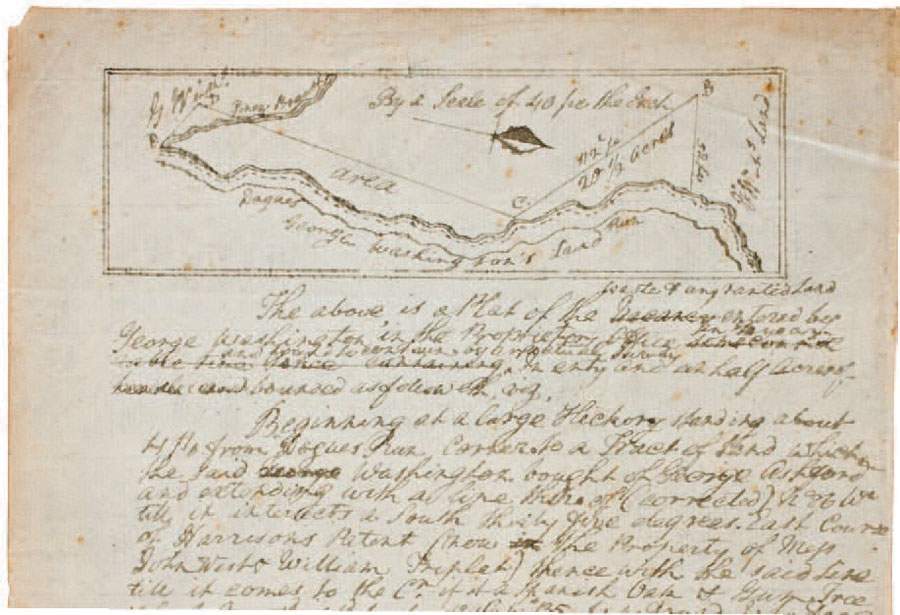

a plat map drawn and signed by George Washington, land speculator and treasonous rebel

Specifically, regarding Trump: his tax picture is deeply tied to real estate. The US tax system has always been preferential to real estate ever since Alexander Hamilton’s days and it had nothing to do with George Washington being the US’ largest land speculator. And, by ‘speculator’ I mean, “Washington owned more land than anyone else in the US and several other land speculators put together.” And, by ‘nothing to do with’ I mean “of course it did.” It had everything to do with the fact that the oligarchs who founded the country all owned huge estates. Washington started with 32,000 acres and kept acquiring more throughout his life.

The US tax code is designed to allow rich people to accumulate value in their properties [by which I mean real estate, stocks, art, and other investments] and they only pay taxes on that value when they cash out. So, if you’re Trump and you buy a building for $10 million, you don’t owe taxes on the change in value of the building unless you sell it. Let’s say the building goes up to $100 million – you pay state property taxes on the $100 million building (state taxes are heavily discounted) but for tax purposes you own a $10 million building and your tax liability only kicks in following a sale. So, you can bet that most of Trump’s “wealth” is on paper – and highly manipulated – based on the difference between the cost of assets he bought and their current value. If the building is worth $100 million and Trump paid $10 million for it, he can say he’s worth $100 million more even though the building is tax-loaded and he’d have to write a check to the IRS for a lot of money if he was honest when he sold it. Of course, he’s not honest about that, either, but as Trump himself has said he’s playing the tax system, and he’s all about debt. Here’s where it gets crazy: if he bought that $10 million building with debt, he can deduct the debt service (interest) from his current taxes, in some cases. Everything looks great so long as nothing is sold for a gigantic profit. Just like George Washington did it, too.

This is the same trick that allows Warren Buffet to famously pay less on his taxes than his secretary does. Why? Because Buffet owns tons of stock in Berkshire Hathaway, worth $billions today but those shares cost him pennies when he bought them. As long as he’s sitting on the shares and not selling them, it’s paper wealth and it’s not taxable. If his secretary sells a few shares to buy a mansion (Buffet’s secretary is very rich) they have to pay taxes on the difference between what they initially paid for the shares and what they made on the transaction.

Trump’s paper wealth is largely a matter of claiming debt as assets. He heads up a financial consortium to buy a golf course, invests some money in it, pays for the debt service on the loan using the membership fees, and his paper debt-wealth skyrockets but he’s still got no tax assessed against him until he realizes profit. Which – in case you noticed – Trump is very good at not doing. The Trump Organization is the entity that the Trumps have created that realizes the profits, and pays the taxes. Donald and his frogspawn own the Trump Organization and their shares in it – like Buffet’s shares in Berkshire Hathaway – get worth more and more on paper but the Trumps don’t pay any taxes on any of that, at all, until they sell a share (and that share is tax loaded as long term capital gains at a fixed maximum of 25% or so) By now you ought to be thumping yourself on the forehead saying, “I bet the republican tax cut’s focus on long term capital gains was a complete accident!” [If you read my Capitalism 101 posting on stock options, you’ll have seen all this coming a mile off: stderr]

Back in the day, when Hillary Clinton’s commodities trading was being investigated, Congress got very excited about how she made a large fortune out of, well, no money up front. I knew people who were saying “she’s so corrupt!” and I had to explain to them that the entire system is so corrupt that what would happen was Congress would realize that that was where all their money was coming from, too, and they’d stop investigating Clinton. That’s exactly what happened. Trump’s a debt-balloon and Congress can’t pop that balloon because they’re all loaded the same way. Remember Mitt Romney’s Bain Capital? He created that and granted himself his ownership shares in Bain at fractions of a penny on the dollar. Bain is now worth $billions so the shares are worth hundreds of millions, but Romney is only tax-loaded on shares that he sells and that tax load is capped at the long term capital gains rate. Not to pick on Mitt, but he probably doesn’t pay much more tax than Trump does, so you’re not likely to see him winging any rocks in Trump’s direction. They’re all in on it, except (possibly) the new members of Congress who have not been thoroughly corrupted, yet.

Any investigation into Trump’s debt balloon will stop suddenly the second Congress realizes it’s pointing the finger at itself, too.

Whatever happened to “buy low, sell high?”

Of course there’s meat in the Trump tax returns. Between the bread and cheese there are going to be significant scraps of meat – namely that Trump has doubtless been hyper aggressive about using the Trump Organization to pay for all of his stuff, which is a minor form of tax cheating that almost all rich people engage in. (That’s why rich people have Kennedy Foundations, Clinton Foundations, and Trump Organizations) – if your foundation lends you its private jet, you’re supposed to recognize some of the value of the jet transportation on your taxes, i.e: the $10 million dollar Gulfstream IV that my corporate self let my private self use – that’s worth $10,000/year because I don’t have to pay for economy tickets on United. There’s going to be tons of that sort of thing in Trump’s tax returns. The truth is that Trump is probably scared of having that stuff raked over the coals because any rich person’s going to look like shit when they have to explain to taxpayers that they wrote off $60,000 to fly their dressage horse to Europe so they could compete in an event. [That’s a Romney reference] – Betsy DeVos probably has her yachts owned by a shell corporation, and Hillary Clinton and Bill fly around the world first class (when Bill’s not flying Jeffrey Epstein’s flying fuck palace) on the Clinton Foundation.

Congress is going to take a quick look at Trump’s tax returns and kill the story, because the only news is going to be really stupid, piddly stuff like that Trump probably wrote off every payment he ever made to every playboy bunny as “corporate entertainment” as expenses for Trump Organization, and didn’t declare the value of that entertainment on his personal taxes. They’re going to recoil from exploding that story because it’s going to be a massive mess that makes the “Russia influence on election” story look like “See spot run” in terms of narrative simplicity.

Trump borrows money against himself – against his reputation and his assets – so he’s not really “making money”; he just inflates those assets and deflates them again when it’s convenient to him. That’s the same trick that his father used to transfer him $400 million worth of assets without him paying taxes on them in the first place. Did you see how that story came out, got brief air-play, and then sank into the deep silent waters like a stone? Why did that happen? Because that’s how congresspeople transfer their assets, too!

Note that there are “honest” ways to do that sort of maneuver. Remember “Bowie Bonds”? David Bowie wanted to make a ton of cash off his music rights, so he did a private bond issue against his future music revenues. He sold people a slice of his future music revenues for $40 million today. It was actually a good deal for the people who bought in, because Bowie’s future music revenues turned out to be pretty good, but Bowie had the cash. Brilliant. Especially because Bowie made sure he was a legal resident of some Caribbean Island (Antigua I think it was) where pirates and slavers (like John Hancock!) used to shelter their assets and everyone lives tax-free. As my accountant says: “A dollar earned tax-free is $1.40, in your tax bracket, pal!” What conmen like Trump do is a bit more sneaky than Bowie’s fairly straightforward grift, but that’s what you’re seeing when Trump says his name attached to a project is worth $1billion. Here’s how that works: imagine that I incorporate Badger Forge and value it at $10,000 – the value of the used scrap-cost of my gear. Badger Forge is now a legal entity, it’s just not worth very much. But, Badger Forge hires stable genius knife-maker Marcus Ranum, who agrees to work in return for stock! For just 50% of the shares in Badger Forge, Marcus Ranum will come work there and make messes on the floor. Badger Forge issues a press release (on Instagram) declaring that Marcus now works there! Badger Forge, declares that its hiring of Marcus Ranum makes the company worth $100 million! Marcus’ shares are now “worth” $50 million but Marcus owes no tax on the shares unless he somehow sells them. See how that works? If Marcus holds the shares for more than a year, the tax-rate on any profits he realizes on the shares is capped as capital gains. In the meantime, Marcus can drink Cristal and drive a Lamborghini if – and only if – he can find a bank that is stupid enough to buy those shares. But, if Marcus is like Donald Trump, what he does is goes to Deutsche Bank and borrows $10 million (in real cash!) against the value of the $50 million Badger Forge shares. The $10 million is put in a Grand Cayman bank account and some of it is used to buy Lamborghinis and hookers, propane and a new lathe, and the rest is used to pay the debt service to Deutsche Bank. That’s illegal – that part about using borrowed money to pay off a loan – so if I was Donald Trump I’d get another loan using my $100,000 CNC milling machine (bought with the $40 million) and use that money to service the debt.

To make a long, sordid, story short: all we’ll learn from Trump’s taxes is that capitalism is a con and that “Congress” starts with “Con” and they will shy away from the light of day like vampires from garlic.

Wait a minute. Are there no real estate taxes? WFT?

Where I live, if you own any real estate that’s located within the borders of the country, you are obliged to pay a tax on your property each year. It doesn’t matter what you do with your property nor does it matter if the property is owned by some corporation that’s registered in another country. If you fail to pay the tax, you will be introduced to debt collectors who may take your real estate from you.

Ieva Skrebele – those are the state taxes I referred to. There have been various attempts to also assess taxes on other unrealized gains (alternative minimum tax) but those have not worked well. Trump is very good, apparently, at inflating the value of his property when he wants to use it as collateral for a loan, and deflating it when it’s tax time. That is fraud but everybody does it so nobody will point at Trump.

I was not clear when I used the word “properties” – there’s real estate, there’s also stocks and other assets.

It’s when I read things like this that I kick myself that I wasted so much of my youth filling my head with useless nonsense like thermodynamics and fluid mechanics, when I had the basic skills to learn something *useful*.

There’s a lot of stuff I didn’t try to fit in here about state and local taxes, and how you can avoid those on your real estate. If you want to really have your head explode with rage, you can read Malcolm Gladwell’s piece on golf. Short form: golf course owners have arranged to manipulate the tax codes in many jurisdictions so that their taxes are not assessed on anything close to the real value of the land. So, you can have a golf course that could be worth $500million for its value if you put housing and stores on it, but because it’s a golf course it’s worth only a little bit more than you originally paid for it 100 years ago. Oh, and, of course, you get to keep it private and keep the public off the land.

Long term capital gains. Ha. The first 39K after deductions are tax free.

I’ll be wishing the first 39K of earned income was tax free if come out of retirement and start working again.

Careful, now – I’ve only met one hooker who knew what she was doing with a lathe.

Well the Trump tax returns, I am sure, would make interesting reading. Who knows they might qualify for a Hugo or Nebula Award.

OTOH the US Congress has a bill before intended to

(1) the estimated net worth of Vladimir Putin and his family members;

(2) a description of their legitimately and illegitimately obtained assets, including all real, personal and intellectual property, bank or investment or similar accounts, and any other financial or business interests or holdings, including those outside of Russia;

(3) the details of the legitimately and illegitimately obtained assets, including real, personal and intellectual property, bank or investment or similar accounts, and any other financial or business interests or holdings, including those outside of Russia, that are owned or controlled by, accessible to, or otherwise maintained for the benefit of Vladimir Putin, including their nature, location, manner of acquisition, value, and publicly named owner (if other than Vladimir Putin);

……

https://viableopposition.blogspot.com/search?updated-max=2019-04-05T08:30:00-03:00&max-results=1

At this rate, Russian standup comedians are never going to run out of material.

Yet other presidential condidates (that “o” was a typo I decided not to correct) had no hesitation in releasing tax returns, including Romney, Clinton, etc.

One should not be too reflexive, or blindly fanatical, about it but it serves that Trump doesn’t want it, and he is willing to expend resources to resist it, so it makes some sense to go after it. Whatever it may be. Trump and his allies don’t have an unlimited supply of time, attention, lawyers, money, news cycles. or patience of the generally unconcerned citizenry. As long as the cost is low any favorable return is ‘gravy’.

There is also some significant chance that what Trump might find most embarrassing is less about violations of the tax codes and more about hidden betrayals of friends and family.

While I agree that no great hope should be placed in what might be revealed, or its effect on the rapidly numbing minds of the general population, not to mention the entirely closed minds of the MAGA true believers, one never knows. Trump’s tax returns are a proverbial ‘box of chocolates’.

Honestly, I can only imagine the fact that he still hasn’t released his tax returns means there’s something in there WORSE than going through a ton of loopholes to avoid paying taxes. He’s already on record as saying not paying taxes “makes him smart” and all.

That said, knowing him it could also just be he doesn’t want people to find out he’s not worth as much as he claims to be.

Dass Istnumberwang@#10:

it could also just be he doesn’t want people to find out he’s not worth as much as he claims to be.

Considering that he has made that claim in the context of applying for loads, that’s “fraud.”