Workers in the fast food industry are going on strike across the country demanding that their wages be increased so that they can live on them. It is long overdue that the minimum wage be doubled to somewhere around $15 per hour. That would do more to end poverty than many of the anti-poverty programs that currently exist.

As William Domhoff shows in a detailed analysis, the level of income and wealth inequality in the US is a scandal and getting worse. There has to be a concerted effort at redistribution and doubling the minimum wage would be a good start.

The objection to this move is that it would hurt the economy. I am not an economist but I don’t buy it. It would mean that the rest of us would pay more for things, but the increase would be nowhere near as large as people imagine. Here is a look at some of the impact that doubling the wages of McDonalds workers would have on the cost of their products.

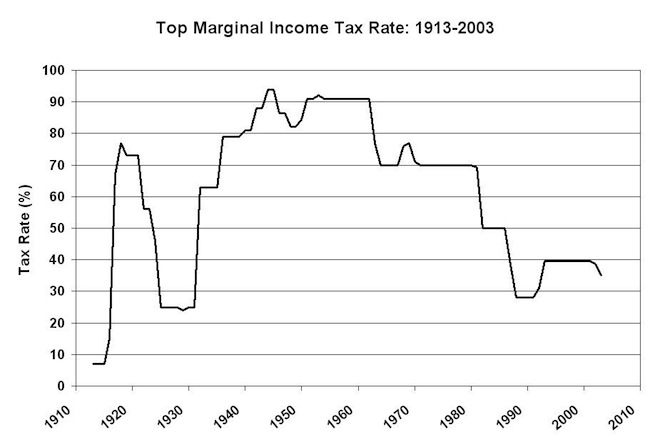

I would also like to see a doubling of the marginal income tax rates at the upper levels, with the top bracket being at least 70% (compared to the current 35%) but that seems impossible in the current political climate. Paul Krugman says that a Rawlsian model of justice would call for a top tax rate of between 73% and 80%. We should recall that the top rates have been over 90% in the past and even during the Truman and Eisenhower days was around 75%. This was a period of solid growth for the middle class. Starting in 1980 the top tax rates started decreasing from its then value of 70% and this also marked the beginning of increasing inequality.

Also, it’s not like the money would just disappear… If you give poor people more money they tend to spend it, which is good for the economy. (Unlike when you give rich people more money, as they tend to hoard it in offshore tax havens, in which case it does disappear, to all intents and purposes.)

I think some (not all, maybe not even most, but some) of the opposition to increasing the marginal rate at the top tax bracket is that there need to be at least one or two more brackets. A family making $400k/yr in a place with a very high cost of living, well there’s no doubting they’re quite well-off, but maybe not quite so well-off that I feel comfortable taking 3/4+ of their marginal income. Somebody making a couple million a year, though, I have no qualms whatsoever about that kind of marginal rate.

I feel like the top tax bracket shouldn’t just be “rich” but should be like “monocle and top-hat, mustache-twirlingly rich”. And that’s not the case right now.

In any case, the minimum wage is goddamn shameful, no matter how you feel about tax rates. At a certain level, raising the minimum wage is a tradeoff between better quality of living for those who are stuck on the bottom vs. slowing the economy — but we’re not at that level. At the level we’re at, raising the minimum wage would likely be a boon to the economy, since it would give consumers a lot more to spend…

I get your qualm about the “monacle-and-top-hat” vs. “successful professional” distinction. The answer for that isn’t “don’t raise the top tax rate, because it will catch both those guys” but “raise taxes on the successful professional a little, and then add a couple more tax brackets at the top to raise Rich Uncle Pennybag’s even more.” During the Great Depression, this was done to such an extent that at the very top there was a tax bracket that had precisely one household in it…

This might work even better in conjunction with a “money is money” rule, such that the tax code doesn’t care how you got the gazillion dollars -- a dollar of capital gains is taxed the same as a dollar earned slinging cheeseburgers.